Worst case for machine operators: liability damage to an old machine

The bitter classic for numerous manufacturing commercial enterprises that operate machines in an industrial environment is when an old machine is damaged. Often the machine still served its purpose in the company. If it is damaged by a third party, in the vast majority of cases a cost issue begins.

An example of the problem

A subcontractor is working in production and drives with the truck and tilted trough against the head of a very old conveyor. The subcontractor reports this to his liability insurance. The latter examines the cost of repair or restoration and, after examination, comes to the conclusion that the current value is lower than the cost of repair. This is the classic “economic total loss”.

The operator is then compensated for the “current value machine”, but can neither pay for the repair nor purchase a new machine. The old tape machine, which performed its services until damaged, is “junk”. If things go badly for the operator, the liability insurance company will also deduct the residual value / scrap value when settling the current value.

In the liability claim for old machines often applies:

The operator is the big loser, even though everything is legally correct.

Real problems with valuations

When determining the value of machinery, industrial plant and equipment, there are rules that guide the valuation. However, a value determination can never be as exact as the result of a mathematical task based on the laws of physics. This means:

1 + 1 can add up to 2, but it can also be just off the mark.

The result may still be accurate. One must be aware of this when carrying out a valuation in the area of machinery, industrial plant and equipment. Two evaluations of the same facts are never exactly identical.

However, if there are significant deviations, caution is advised.

In order to avoid discussions as far as possible, a valuation must therefore be carried out in a comprehensible, objective and factually sound manner and, above all, documented so that an external third party is enabled to understand the determination of the values, for example the “current value of machinery”.

Why valuations?

Bewertungen werden für unterschiedliche Zwecke durchgeführt. They are required, for example, by manufacturing companies

- the conclusion of an insurance policy (property insurance);

- in the event of a claim for the

- Property insurer (fire/fire, machinery breakdown) and/or

- Liability insurer in the event of a liability claim;

- for banks at

- Financing,

- Lending or for

- Purchase and sale.

In court proceedings, the parties want to know the amount in dispute. A bank wants to know what loan collateral is offered. A corporate buyer wants to know what price is realistic. A tax advisor needs data for tax and accounting classifications. The insolvency administrator wants to know the value of the bankruptcy estate. Neither buyer nor seller may know the realistic price to be paid for an item being sold.

When selling: the market is important

In the field of mechanical and plant engineering, the industry is important. A machine tool will always be easier to sell in case of doubt because the market is bigger than, for example, a pallet cleaning machine.

This is why it becomes clear what potential for conflict there can be, because there are usually different interests of all parties involved in certain valuations, for example

- Sellers with “their” values,

- Valuation of experts,

- the potential buyers on the market.

Experienced appraisers will therefore always obtain market information when determining market values and take this into account. When determining the “current value of the machine”, new values are obtained or purchase invoices are checked and extrapolated.

In the event of damage: Market value and/or current value machine?

In the event of a claim, it must first be differentiated what type of damage it is. If there is fire damage or fire loss, the property insurer settles. This also applies in the event of machine breakage. The replacement value is replaced. In some cases (40% rule), only the “current value machine” is reimbursed by the property insurer.

If it can be established that, for example, a third party is responsible for the damage (e.g. fire damage), the property insurer will take recourse against its liability insurance. Then the liability insurance of the causer will bear the current value of the damaged machinery, equipment and operating facilities.

In the case of liability damage, the current value is compensated.

The “current market value of the machine” is a particularly important parameter in the different claims.

Determination "current value machine

According to the definition

Current value the value of the machine or plant taking into account age, operating condition, in particular wear and tear and maintenance, servicing, use and the average technical life and useful life.

Several methods exist to determine the fair value. If the acquisition value or the new value is known, three methods are available to determine the devaluation.

Time value factor (ZWF)

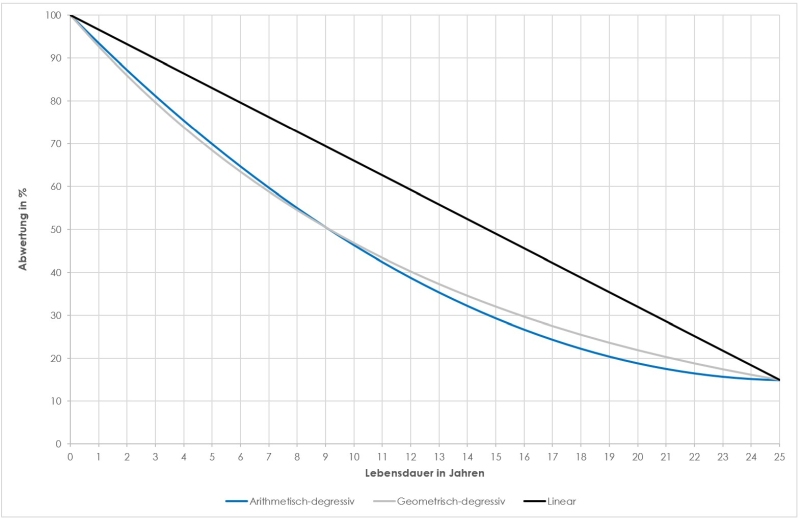

The geometric-degressive devaluation is based on a varying reduction in value over the useful life of the valuation object. High devaluations result in the first years of the useful life.

In linear devaluation, the devaluation rate is equal to the partial devaluation amount; both are constant. Each year is devalued by the same amount until the residual value is reached at the end of the useful life.

In this form of devaluation of the arithmetic-degressive devaluation, devaluation at the beginning of the useful life is stronger than after linear devaluation but not as strong as after geometric-degressive devaluation. This method best represents reality for most machinery, equipment and operational facilities, and is especially commonly used to determine “current value machine.”

Utility factor (GBF)

One or more site visits are necessary for the determination of the “current value of the machine”.

The current value of a machine is determined not only by the current value factor (ZWF) but also by the used value factor (GBF). During on-site inspections, knowledge gained about equipment scope (accessories), condition, overhauls, repairs performed, and quality of work are included in this factor.

Therefore, their classification in an evaluation scheme is necessary, which, due to the diversity of objects, cannot be uniform, but must be adapted depending on their nature and the requirements placed on them with respect to the factors mentioned.

Some classic questions are:

- Is the machine in the retracted state?

- Does the machine meet the set requirements?

- Can the machine only be used for certain jobs?

- Have there been any repairs and maintenance?

New value or acquisition value?

The “current value machine” is determined from the new value, the used value factor and the current value factor. Alternatively, it is determined from the acquisition value, the price increase, the current value factor and the used value factor.

If the new value is known or can still be determined, the new value is used for devaluation.

The new value is the market price of the unused good valid on the valuation date, including all costs incurred to make the good ready for use.

If, on the other hand, the new value is unknown, often in the case of old machines, an attempt is made to determine the acquisition value.

The acquisition value includes the costs that had to be spent to acquire the machine or equipment at the time of acquisition.

The “fair value machine” is determined from the value as new as of the valuation date as follows:

The “fair value machine” is determined from the acquisition value at the valuation date as follows:

Price increase

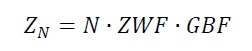

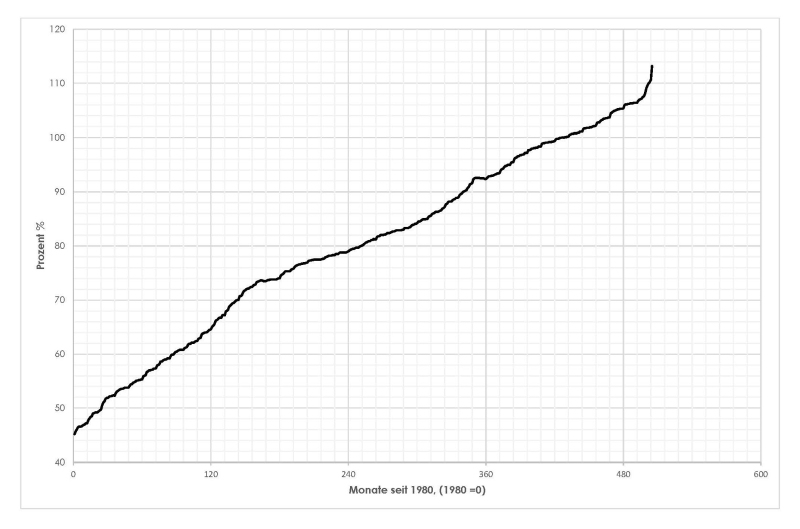

Factor I is the index of price increases since acquisition to the valuation date. The data are available, for example, from the Federal Statistical Office.

If a machine was purchased in 2000 and the net acquisition cost in June 2000 was DM 100,000.00, one can extrapolate to a valuation date in January 2022 as follows:

- Index in June 2000 =79,6;

- January Index 2022 = 113.2.

- From this follows the price increase I=113.2/79.6 =1.4221.

You can therefore notionally extrapolate to January 2022 and take into account the conversion from DM to €:

Zn = 100,000 /1.95583 € * 1.4221= 72,711.00 €

The new value, fictitious determined from the known purchase price from June 2000, is then approx. €72,711.00 for January 2022.

"Time value machine"

In the above example, the notional new value or, if ascertainable, the new value at the time of the loss is multiplied by the current value factor (CF) and the value in use factor (VF). This results in the fair value as of the valuation date, in the case of liability claims, equal to the date of occurrence of the claim.

Conclusion

Many factors influence the “time value machine”. The more conscientiously the fair value is determined, the more accurate it will be.

Particularly in the case of damage to old machines, determining the current value can be a problem in reality, because the maximum current value is settled in the liability claim and any residual value is also deducted.

The injured operator of an old machine (“old machine”) that was functioning until the damage occurred is in almost all cases the loser of a legally completely correct process. He will only be reimbursed for the current value minus the residual value if the repair costs are higher. This characterizes the economic total loss. With it can not be repaired. For the new acquisition, the operator must invest, which is not always possible. In almost all such cases there is a problem to complete the orders for which the machine damaged by third parties was used.

Recommendation:

The determination of the current value and generally the valuation of machinery, equipment and operating facilities should be carried out by experienced experts. If there are large deviations between one and the same evaluation, critical questions should be asked.